Get the Coverage You Need.

No More, No Less.

Protect Your Family with Term Life Insurance.

Your most valuable asset is your income. Let us help you protect it—and your family.

More than one in three parents with children under the age of 18 have no life insurance. And 33% of those that do have less than $100,000 in coverage.1

In the event of an unexpected death, your family needs to be protected from the potential loss of income. Through an affordable term life insurance plan, you can get the coverage you need. And Capital Choice can help you find the plan that’s right for you to help cover expenses — from debts, to the mortgage, and other every-day costs — should something happen.

1 “Survey: How many of us have life insurance? And how many have enough of it?” Bankrate, July 8, 2015Don’t get stuck with a policy that doesn’t properly protect your family.

Term life policies are easier to understand and more affordable than whole life insurance. A 30-year-old male, for example, may pay around $4,675 a year for whole life versus only $242-$403 a year for term life.2

This cost difference allows you to invest the saved money and/or apply it toward a debt—bringing your financial wellness plan full circle.

2 “The Differences Between Term and Whole Life Insurance” NerdWallet, March 29, 2017

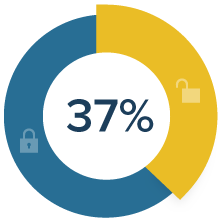

37% of parents with children under the age of 18 don’t have life insurance.3

3 “Survey: How many of us have life insurance? And how many have enough of it?” Bankrate, July 8, 2015

So, how do you determine the right amount of coverage?

With the DIME Method. This technique gives you a complete view of your financial profile. By segmenting your finances into the four DIME categories—death and debt, income replacement, mortgage, and education—you can determine the coverage you need to protect your family against potential income loss from an unexpected death.

Death & Debt

This is the amount of money needed to pay death expenses and settle any remaining debts.

Income Replacement

This is the amount of money needed to cover monthly living expenses for your surviving family.

Mortgage

This is the amount of money needed to pay off any outstanding mortgage balance.

Education

This is the amount of money needed to pay for your child’s—or children’s—education.

Liquid Assets (If Applicable)

This is the amount of money you currently have in the form of liquid assets.

Add these amounts together, and you can get an idea of how much coverage you need. And the good news is, with term life insurance, coverage is extremely affordable — typically a fraction of what most whole life premiums are.

Our Partners

We partner with industry leaders to offer our clients products and services that match their individual needs and goals.

Capital Choice provides the resources I need to educate and support clients on their journey to financial wellness.

The flexibility of our approach, combined with our partner products, allows me to help clients achieve their financial goals — regardless of their situation.

We give clients the knowledge they need to get out of debt, stay out of debt, and save for the future of their dreams.

At Capital Choice, we help free everyday families from the stress of debt, so they can focus on what matters most to them.

With Capital Choice, I can help families in my community save and plan for the future — to help them reach their goals and dreams.

Insuring your income is the most important thing you can do for your family. We help our clients do just that with affordable term life insurance.

Doing what's right and best for our clients is the Capital Choice way, enabled by and executed every day through the freedom of choice.

Interested in learning more? Contact Capital Choice today.